Retirement planning often seems like a distant concern, especially for individuals in their 20s or early 30s. However, starting early with your investment strategy can yield significant benefits in the long run. Early investing is not just about saving money; it’s about leveraging time to grow wealth, ensuring financial independence, and securing a comfortable retirement. Here’s an in-depth look at why starting early is one of the smartest financial moves you can make for retirement.

1. The Power of Compounding

One of the most compelling reasons to start investing early is the magic of compounding. Compounding occurs when the returns you earn on your investments are reinvested to generate even more returns. Over time, this snowball effect can lead to exponential growth in your retirement savings.

For instance:

-

If you invest $5,000 annually starting at age 25 and achieve an average return of 7%, your portfolio could grow to approximately $1.18 million by age 65.

-

If you start investing the same amount at age 35, your portfolio would only grow to about $567,000 by age 65.

The earlier you start, the more time compounding has to work its magic, turning modest contributions into a substantial nest egg.

2. Lower Financial Stress

Starting early spreads the financial burden over a longer period, allowing you to invest smaller amounts consistently. This reduces the pressure of trying to catch up later in life when expenses like a mortgage, children’s education, or healthcare may compete for your attention.

For example:

-

A 25-year-old investing $200 per month can build a sizable retirement fund.

-

A 45-year-old may need to invest $800 or more per month to achieve the same goal due to the shorter time horizon.

This flexibility in contributions can make the process of saving for retirement less overwhelming.

3. Ability to Take on Higher Risks

Young investors have the advantage of time on their side, allowing them to take on higher-risk investments with the potential for higher returns. Investments like stocks, mutual funds, or equity-linked savings schemes (ELSS) are volatile in the short term but tend to offer superior returns over decades.

A young investor can afford to ride out market fluctuations, knowing they have time to recover from downturns. In contrast, those who start late often have to prioritize conservative investments, which may offer lower returns.

4. Opportunity to Learn and Adjust

Starting early provides a learning curve for understanding the financial markets and honing your investment strategy. You can experiment with different investment options, learn from mistakes, and refine your portfolio over time.

Early investors also have the flexibility to adjust their retirement goals and strategies based on changes in income, lifestyle, or financial priorities. This adaptability is invaluable for long-term success.

5. Protection Against Inflation

Inflation gradually erodes the purchasing power of money over time. To maintain your standard of living in retirement, your investments need to outpace inflation. Starting early gives your portfolio more time to grow and beat inflation, ensuring your savings retain their value.

For example, if you need $50,000 annually for expenses today, you might need $100,000 or more per year in 30 years due to inflation. Early investing helps you build a larger corpus to meet these increased expenses.

6. Building a Disciplined Financial Habit

Investing early instills a sense of financial discipline and responsibility. Regularly contributing to your retirement fund teaches you to prioritize saving over unnecessary spending. This habit often extends to other aspects of financial planning, such as budgeting, debt management, and setting aside funds for emergencies.

Automating your investments through systematic investment plans (SIPs) or employer-sponsored retirement accounts can make saving effortless and consistent.

7. Tax Advantages

Many retirement investment options offer tax benefits that can reduce your taxable income. For instance:

-

Contributions to 401(k) plans or traditional IRAs in the U.S. may be tax-deductible.

-

In India, investments in schemes like the Public Provident Fund (PPF) or ELSS offer tax exemptions under Section 80C of the Income Tax Act.

By starting early, you maximize the tax advantages over a longer period, further boosting your retirement savings.

8. Peace of Mind

Early investing not only secures your financial future but also provides peace of mind. Knowing that you have a well-funded retirement plan reduces anxiety about the uncertainties of the future. This mental assurance allows you to focus on other life goals, such as career advancement, travel, or personal growth, without constantly worrying about money.

9. Freedom to Retire Early

Starting early opens up the possibility of achieving financial independence sooner. With a robust retirement fund, you can consider retiring earlier than the conventional age of 60 or 65. Early retirement gives you the freedom to pursue hobbies, travel, or volunteer without financial constraints.

Practical Tips to Start Early

-

Set Clear Goals: Determine how much you’ll need for retirement based on your desired lifestyle and inflation.

-

Start Small but Stay Consistent: Even if you can only save a small amount, the key is consistency.

-

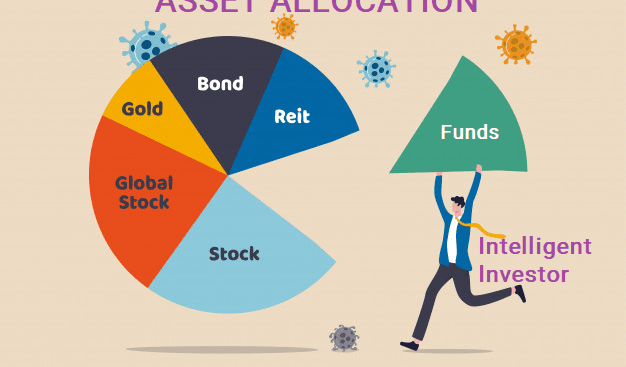

Diversify Your Portfolio: Spread your investments across asset classes like stocks, bonds, and real estate to balance risk and reward.

-

Take Advantage of Employer Plans: Contribute to employer-sponsored retirement accounts to benefit from matching contributions.

-

Reassess Regularly: Review your portfolio annually to ensure it aligns with your goals and risk tolerance.

Conclusion

Investing early for retirement is not just a financial strategy; it’s a gift to your future self. The benefits of compounding, financial flexibility, and peace of mind far outweigh the initial sacrifices. By starting now, you’re not just saving money; you’re buying time, freedom, and security for your retirement years. So, don’t wait—take the first step today and set yourself on the path to a stress-free and fulfilling retirement.